101 Guide to the LNSwap Crypto Aggregator

Learn how swap protocols use crypto aggregators and what’s coming to LNSwap in the near future.

As DeFi (decentralized finance) continues to evolve, DeFi protocols are becoming more sophisticated and feature-rich. Now, aggregators have emerged as an important feature. But if you don’t know what all of this means, it’s easy to get lost in the complex ecosystem that makes up the crypto market.

In this quick guide, we’ll walk you through aggregators and how LNSwap uses them to make swapping cryptocurrencies easier and more efficient. We’ll also share what’s coming in the near future for the LNSwap crypto aggregator.

Introduction to LNSwap and its Aggregator

Along with L2s, aggregators are pushing DeFi forward and making decentralized swap protocols like LNSwap more user-friendly. But what exactly is LNSwap and how does it work?

What is LNSwap?

LNSwap is a decentralized, peer-to-peer (P2P) swap protocol that allows two parties to directly exchange crypto assets (specifically BTC and assets on the Stacks Bitcoin layer) without an intermediary.

For example, if you have BTC but you want STX, you can find a counterparty who has STX but wants BTC. To begin, you need to specify which assets you want to swap and at what amounts.

The swap protocol does the work of executing on-chain smart contracts and locking each user’s funds until the swap is successfully completed through Hashed Timelock Contracts (HTLCs). By locking the funds during the swap, the protocol ensures every trade remains trustless.

Swap protocols make the entire token swap process easy by facilitating this discovery, communication, and execution. In addition, by using a swap protocol, both users maintain control over their crypto assets throughout the duration of the swap.

Using direct, P2P swaps without centralized intermediation, LNSwap protects users from having to deposit funds with a custodial third party.

What’s a Crypto Aggregator?

A crypto aggregator platform is a service that gathers data and access from various crypto sources into a single interface. This simplifies and improves efficiency for activities like trading, lending, and swapping.

Crypto aggregators connect to crypto exchanges, liquidity pools, lending protocols, derivatives platforms, and other DeFi sources. Taking these fragmented sources, aggregators give users a single point of access to optimized pricing, asset availability, rates, and more.

With an aggregator, users can quickly and easily find a larger pool of assets at better trading rates. It also becomes much easier for users to find the crypto coins or tokens they’re looking for and see fees and maximum swaps with minimal effort.

Aggregators may create a more user-friendly experience for investors because they save time searching for information across different platforms. And they interact directly with on-chain smart contracts. Though aggregator fees may be higher, consider them a "convenience fee" that saves you time and effort.

Benefits of Crypto Aggregators

As we’ve already mentioned, a major benefit of crypto aggregators is a simplified user experience finding and executing cryptocurrency swaps.

Making a completely decentralized, peer-to-peer swap, is complicated. Traders and investors need to monitor multiple blockchains, track funds, and watch for contract triggers to ensure the swap terms are fulfilled properly by both parties. This is more complex than most DeFi users can handle manually.

With a cryptocurrency aggregator handling these intricacies behind the scenes, users can focus on the swap terms and execution. Aggregators reduce concern about missing notifications or potential errors in the process. They play an instrumental role in keeping both parties informed and following the required steps to complete crypto trades successfully.

Aggregators Provide

- Access to larger pools of assets and liquidity by combining multiple exchanges and sources.

- User-friendly features like drag-and-drop to visualize and combine trading strategies.

- Automated coordination and tracking for swaps and other workflows.

- Time savings compared to checking rates and pricing across many platforms individually.

- Optimization algorithms find the best prices and execution across fragmented DeFi protocols and platforms.

- Data and analytics on a single platform and help with trading decisions and yield optimization.

Types of Crypto Aggregators

There are several categories of crypto aggregators.

- On-Chain Order Books: Aggregate order books across DeFi protocols that operate solely on-chain. These require on-chain data queries.

- Off-Chain Order Books: Aggregate the order books of DeFi protocols using off-chain relayers/servers. This is faster but partially centralized.

- SOR Aggregators: Use smart order routing algorithms to split orders across multiple protocols to optimize execution.

- Market Maker Aggregators: Are designed for market making bots to optimize trades across protocol markets.

- Hybrid Aggregators: Combine both on-chain and off-chain sources of liquidity and price data.

- Liquidity Aggregators: Pull together liquidity from multiple protocols and provide access to lending protocols, CEXs, and other DeFi sources. This expands asset availability.

- Data Aggregators: Compile on-chain data from multiple blockchains to produce analytics, pricing information, and market data.

- DeFi Aggregators: Aggregate pricing, rates, access, and data across the full spectrum of DeFi including lending, borrowing, trading, derivatives, asset management, and more.

How does the LNSwap Crypto Aggregator Work?

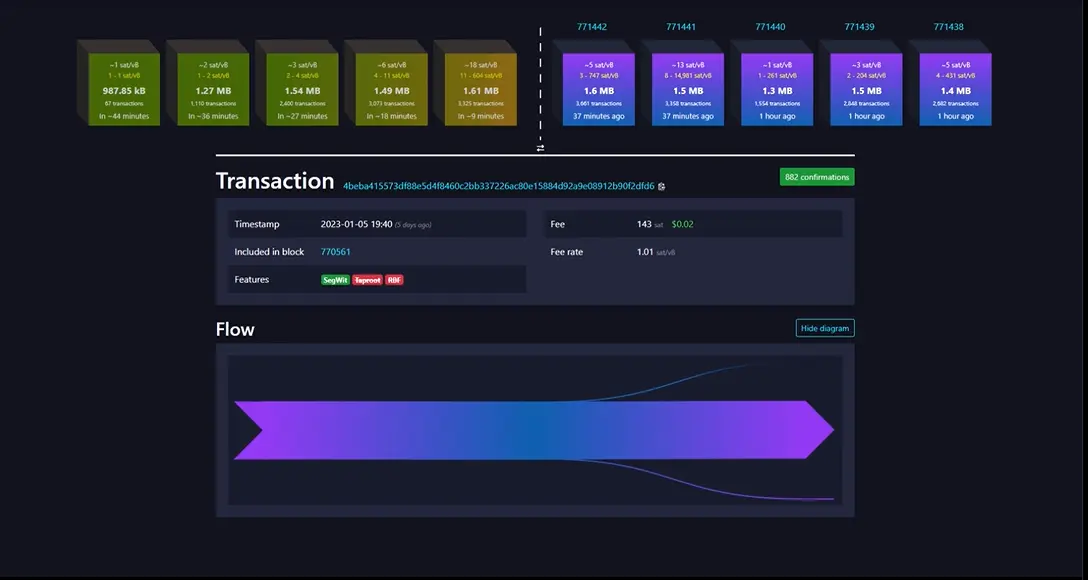

The LNSwap crypto aggregator is a router that connects users looking to swap assets with liquidity providers on the platform. It provides swap requests and facilitates the exchange of information between parties.

When a user initiates a swap on LNSwap, the aggregator forwards their request to liquidity providers who can fulfill the swap. It also handles coordinating the swap workflow and tracking the status on Bitcoin and Lightning networks.

Once a suitable liquidity provider is found, the aggregator oversees the swap process, including generating the HTLC smart contracts and timelocks. It monitors the contract calls and notifications around depositing, swapping, and withdrawing funds.

The LNSwap crypto aggregator allows users to initiate swaps without needing to manually monitor fund transfers or contract triggers.

The Future of LNSwap’s Crypto Aggregator

The team at LNSwap is currently working to transition the aggregator into an on-chain smart contract model. This will allow anyone to become an LNSwap aggregator by running a front end interface that is connected to the on-chain aggregator.

An open, decentralized aggregator greatly increases potential for innovation as builders create more services for users. Developers will be able to build custom front ends with unique features on top of a common, underlying aggregation logic.

Liquidity providers on LNSwap will also be able to flexibly register with multiple aggregators at once. This prevents reliance on any single aggregator implementation and improves redundancy.

LNSwap’s on-chain aggregator will provide the same automated workflow coordination and swap optimization it currently does. But it will do all of that in a transparent and permissionless way that is aligned with principles of decentralization.

The future of swap protocols is bright and LNSwap is working hard to stay at the forefront of usability and cutting-edge technology. Soon, making crypto swaps and building aggregator tools will be easier than ever and LNSwap will be the best platform for the trade.

Start swapping Bitcoin for Stacks

LNSwap is a non custodian crypto currency swap protocol that provides a fast, private way of swapping Bitcoin for Stacks and vice versa.