Crypto Swaps vs. Crypto Exchanges: What's the Difference?

How do crypto exchanges and crypto swaps work? LNSwap, a protocol developed in part by Trust Machines, explains.

The crypto ecosystem is complex. From crypto wallets to stablecoins backed by fiat currencies, the growth of the market has brought about new innovations that have transformed how users interact with their assets. This includes the advent of cryptocurrency exchanges and cryptocurrency swaps. Now, many exchange platforms and trading platforms offer instant crypto swap services.

When someone hears the terms "crypto swap" and "crypto exchange," they might wonder how to distinguish the two. Traditionally, trading or swapping one asset for another occurs on centralized crypto exchanges that many might recognize, such as Coinbase or Binance. But as blockchain technology evolves and the realm of decentralized finance (DeFi) has expanded, new avenues and non-custodial exchange services have emerged.

Decentralized exchanges now offer users the ability to perform crypto swaps without the need for a centralized intermediary. But what sets crypto exchanges and crypto swaps apart? Let's delve into the key differences between centralized crypto exchanges and decentralized crypto exchanges, especially in the context of crypto swaps and trades.

Types of Crypto Exchanges: A Closer Look at Centralized and Decentralized Exchanges

As crypto continues to evolve at a breakneck pace, it's essential for users to understand the nuances between centralized and decentralized exchanges.

Centralized Exchanges

Think of centralized exchanges, also known as custodial exchanges, as the middlemen of the crypto ecosystem. To trade on these platforms, users typically must provide personal details such as their name, address and banking information. After navigating this onboarding process, one can trade various digital assets listed by the exchange. However, this convenience comes with a caveat: trust.

By using centralized exchanges, users are essentially placing their trust in the hands of the exchange itself, which holds complete control over their assets. Historical events like the issues faced by previously popular exchanges Mt. Gox, FTX and Quadriga underline the risks involved. While centralized exchanges offer advantages like customer support, a user-friendly interface and often superior liquidity, users do trade off direct custody of their coins for these benefits.

Decentralized Exchanges

More recently, decentralized exchanges have brought a fresh perspective to exchanging crypto, introducing the concept of crypto swaps. Here, users can directly swap one coin for another. Instead of relying on large, institutional market makers for liquidity, decentralized exchanges turn to everyday users. By depositing their crypto into liquidity pools, these users become liquidity providers who can earn a percentage of fees from every swap made.

The revolutionary feature of decentralized exchanges lies in their trustless transactions. Using smart contracts, users retain full custody of their assets without needing an intermediary. This automated system ensures that users can securely and confidently trade anytime, anywhere, often at a lower fee compared to centralized platforms.

Whether you lean towards the traditional approach of centralized exchanges or the autonomous world of decentralized platforms, both have their own merits. The choice ultimately lies in individual priorities: centralized ease or decentralized control.

An Overview of Trading Cryptocurrency and Crypto Swaps

Grasping how centralized (CEX) and decentralized exchanges (DEX) work lays the groundwork for understanding trading and swapping crypto, which are essential features within the crypto ecosystem.

On a centralized exchange, trading is often orchestrated around an orderbook that enables users to trade one crypto for another. Imagine an orderbook as a ledger detailing various buy and sell orders at assorted prices. When a user opts to trade a crypto asset, another user on the platform complements their action, ensuring a balanced transaction. For instance, selling 10 BTC on a CEX necessitates another user buying the same amount. To smoothen this process, advanced traders, or market makers, typically step in. These institutions, often employing sophisticated arbitrage techniques, keep the trading flow seamless by taking opposite positions, ensuring liquidity and price stability.

Decentralized exchanges, in contrast, take a different approach. Eschewing the conventional orderbook, DEXs leverage liquidity pools. In simplified terms, users amass two types of assets, like wBTC and USDC, in a pool. This pooled resource then operates based on smart contract rules, with price alterations steered by user interactions and the available liquidity. To transact on a DEX, users simply link their digital wallets and prompt a transaction, executing a crypto swap. The popular exchange Uniswap epitomizes this approach.

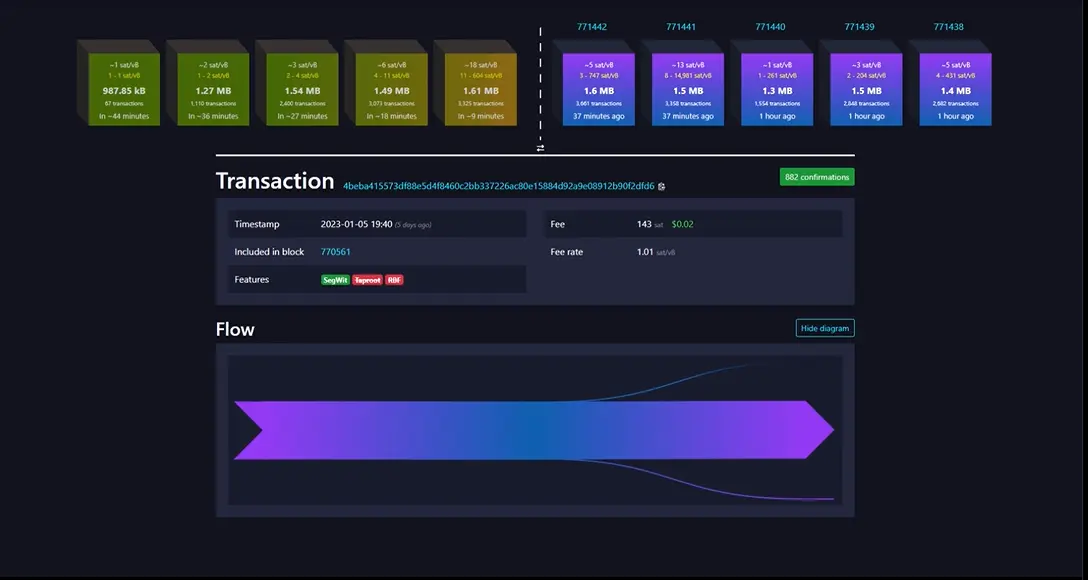

A fascinating adjunct to DEX-driven liquidity pools is the atomic swap, which powers the Bitcoin and Stacks asset swaps offered by LNSwap, a protocol developed in part by Trust Machines. This mechanism enables direct, peer-to-peer crypto exchanges across divergent blockchains, removing the need for intermediaries. Imagine wanting to exchange bitcoin for Ethereum—two fundamentally different cryptocurrencies. Atomic swaps make this feasible without exposing traders to undue risk. The magic behind it? Hashed Timelock Contracts (HTLC). This contract lays out trade stipulations and a time constraint for completion. For example:

- Ryan initiates a smart contract, depositing his BTC into it. This contract then produces a unique cryptographic key, the tool to access the funds, and a hashed variant of that key.

- Ryan forwards this hashed key to Annie. While she can validate the deposit with the hashed key, she can't retrieve the funds until every swap requirement is met.

- Using Ryan's hashed key, Annie creates a subsequent contract and deposits her ETH into it.

- As Ryan accesses Annie's ETH from her designated contract, Annie gets the password to unlock Ryan's BTC deposit.

Through atomic swaps, the realm of crypto trading becomes more inclusive, permitting seamless and secure cross-blockchain transactions, further democratizing the digital asset landscape.

Differences Between Swapping and Trading Crypto

Crypto trades and crypto swaps represent two essential mechanisms in the cryptocurrency landscape, each serving a unique function but with the shared purpose of exchanging one asset for another. Here's a breakdown of their key differences and similarities:

Crypto trades are typically conducted on centralized exchanges (CEXs), and they can encompass fiat-to-crypto exchanges or between different cryptocurrencies. Orders are generally executed instantly via an orderbook. The fees for this process are often slightly higher than those on decentralized exchanges, but the user interface (UI) and user experience (UX) are typically more user-friendly. Users can create an account using basic personal information, making it a familiar process for many.

Crypto swaps are performed on decentralized exchanges (DEXs), and they involve the exchange of one digital asset for another. Unlike trades on centralized platforms, these swaps use liquidity pools to facilitate transactions. Users must pay both a gas fee for blockchain execution and a swap fee to liquidity providers. The UI and UX for swaps can be more complex, requiring users to have a personal blockchain wallet already set up. However, crypto swaps offer more flexibility, including atomic swaps, which allow for the exchange of digital assets across different blockchains.

While both crypto trades and crypto swaps enable asset exchanges, they do so through different methodologies and platforms. Crypto trades offer a more traditional and user-friendly approach on centralized exchanges, often with instant execution. In contrast, crypto swaps, through decentralized exchanges, provide more flexibility and control, albeit with a more complex setup. Both have their own fee structures and cater to different needs and preferences within the vibrant and multifaceted world of digital assets.

Concluding Thoughts

The multitude of trading and swapping platforms, both centralized and decentralized, offers users an array of choices. Centralized exchanges, with their user-friendly interfaces and broader coin offerings, provide a familiar touchpoint for many. In contrast, decentralized exchanges champion a trustless ecosystem, emphasizing direct control and often more cost-efficient swaps.

Additionally, innovations like atomic swaps promise even more seamless cross-blockchain transactions, underscoring the adaptability and potential of blockchain technology. Ultimately, the path a user takes—whether embracing the structured world of CEXs or the autonomous realm of DEXs—will be guided by their priorities and comfort levels.

For those intrigued by decentralized finance, decentralized exchanges, or swapping cryptocurrencies, exploring platforms like LNSwap may be the next step in your crypto journey.

Start swapping Bitcoin for Stacks

LNSwap is a non custodian crypto currency swap protocol that provides a fast, private way of swapping Bitcoin for Stacks and vice versa.